"But states tend to have a much smaller standard deduction. Most employees who incur job-related expenses could deduct some of those costs on their federal tax returns until the 2018 tax year, and may be able to again in 2026. "It will only benefit those whose itemized deductions exceed the standard in that given state," he said. Although you might have unreimbursed business expenses as an employee, you will most likely not be able to deduct them. Meanwhile, the federal standard deduction for the 2019 tax year is $12,200 for singles ($24,400 for married-filing-jointly). In California, it's $4,536 for single taxpayers, while joint filers can claim a standard deduction of $9,074. What's next Thinking of being your own boss? What it means for taxes Why businesses aren't rushing to claim the $130 billion PPP potįor example, the 2019 standard deduction in New York is $8,000 for single filers ($16,050 for married couples who file jointly).

More from Smart Tax Planning: These entrepreneurs are nearly out of PPP funding. This means the deductions claimed on your return must exceed the standard deduction – which will vary in each state.

Typically, unreimbursed employee expenses are an itemized deduction on state income tax returns. These employees may also be able to deduct a portion of their rent, mortgage interest and utility bills that are attributable to that space on their state tax returns, Rigney said. Those extra costs could include new computer monitors, desks and ergonomic chairs, he said. "Folks who are disappointed they won't get a federal tax benefit should go ahead and keep records, including receipts of the expenses incurred," said Rigney. Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions, unless they are a qualified employee or an eligible educator. Personal Loans for 670 Credit Score or Lower Employee business expenses can be deducted as an adjustment to income only for specific employment categories and eligible educators. Personal Loans for 580 Credit Score or Lower

UNREIMBURSED BUSINESS EXPENSES INSTALL

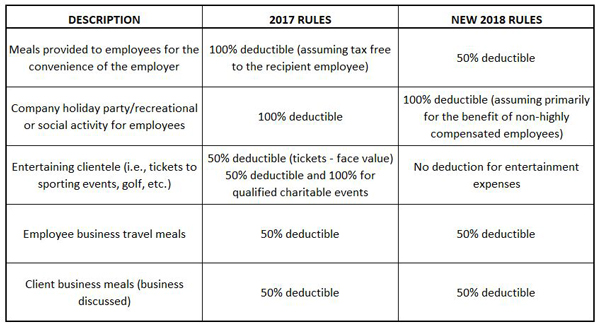

The best way to eliminate any doubt about the proper tax treatment of unreimbursed partnership expenses is to install a written policy that clearly states what will and will not be reimbursed by the firm. In other words, there’s no deduction for “voluntary” out-of-pocket expenses (consistent with the principle that no good deed goes unpunished). Here’s the problem: Partners cannot deduct expenses they could have turned into the firm and been reimbursed. That way the partner receives an SE tax benefit as well as an income tax benefit. The partner should also include the deductible amount as an expense for self-employment tax purposes on his or her Schedule SE. Of course, if the expenses in question are for meals or entertainment, only 50 percent of the costs can be deducted on Schedule E. 162 (a) will be allowed for an unreimbursed expense that is: Paid or incurred during an employee's tax year For carrying on his or her trade or business of being an employee and Ordinary and necessary. The deduction can be described as “unreimbursed partnership business expenses.” Thus, with respect to employee business expenses, a deduction under Sec.

The Schedule E instructions direct the partner to report the deduction for unreimbursed expenses on a separate line below the line reporting the partner’s share of income from the firm. To be eligible for this tax-favored treatment, however, the unreimbursed expenses must be of the kind the partner is expected to pay out of his or her own pocket per the partnership agreement or firm policy.In theory, the agreement or policy can be written or unwritten. The ground rules: A partner can write off unreimbursed business-related expenses on his or her Schedule E (the same tax form where the partner’s share of partnership income is reported). The good news is these unreimbursed business-related outlays can generally be deducted on the partners’ personal Form 1040 tax returns. Pay for some or all costs involved in continuing legal education out of their own pockets.Incur personal auto expenses driving to and from client meetings and to and from other locations where firm-related business is undertaken.Have to personally absorb the costs of wining and dining prospective clients who are not on the “approved” firm-wide list of potential clients for which the firm will reimburse entertainment costs.Law firm partners must sometimes pay for certain firm-related expenses out of their own pockets.

0 kommentar(er)

0 kommentar(er)